Archive

LPs: More GPs than ever will struggle to raise a fund over the next TWO years

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

Two years of winter:/

That’s what awaits those who did/

Not bury their nuts

We all know that times are tough for GPs out fundraising at the moment. But ask anyone on the sell-side and they’ll tell you the same thing:

2009 was horrible, but we expect things to pick up by the end of the year

A quick poll conducted by IE Consulting last month, however, suggests that times will remain tough for those PE houses out scavenging for LP commitments. Of course, the very best funds will come out and raise money. By the way, “very best funds” does not mean “top quartile” (anyone ever marketed a fund that wasn’t top quartile?). “Very best funds” means just that: those private equity and venture capital funds that have consistently delivered performance that outpaces its peers and other funds in other asset classes.

It’s simply no longer enough to be delivering better returns than other European buyout funds or other US venture funds. Limited Partners are taking a hard look at the dollars they are investing in private equity and VC funds and how the returns stack up against their other investment strategies: Commentators should not be surprised to see even committed investors into the asset class “taking stock” for a good while longer than even the most pessimistic might have expected.

So what does this mean for those in the market now, trying to raise a fund?

- Get out early. You could be in the market for 18 months or more

- Be flexible. Respect the fact that the balance of power now rests with your LPs: They have alternatives.

- Show how you are different. A longer fundraising timetable means more “competing” funds on the road at the same time. Why should LPs invest in your fund?

- Don’t forget to make the case for private equity: Is your strategy preferable to investing in the public market? How?

I remember a conversation I had in 2008 with the head of investor relations at one of the preeminent large buyout houses. After exchanging niceties and discussing the industry landscape, talk turned to their current fundraising activity. Apparently, the firm was engaged in “philosophical” discussions as to whether it should even include a market commentary section in its PPM. After all:

“everyone knows what we do and why they should be investing in our funds”

Oh, how things have changed…

You can read the full research summary from our LP poll here:

More than a big deal? What GPs think worth communicating

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

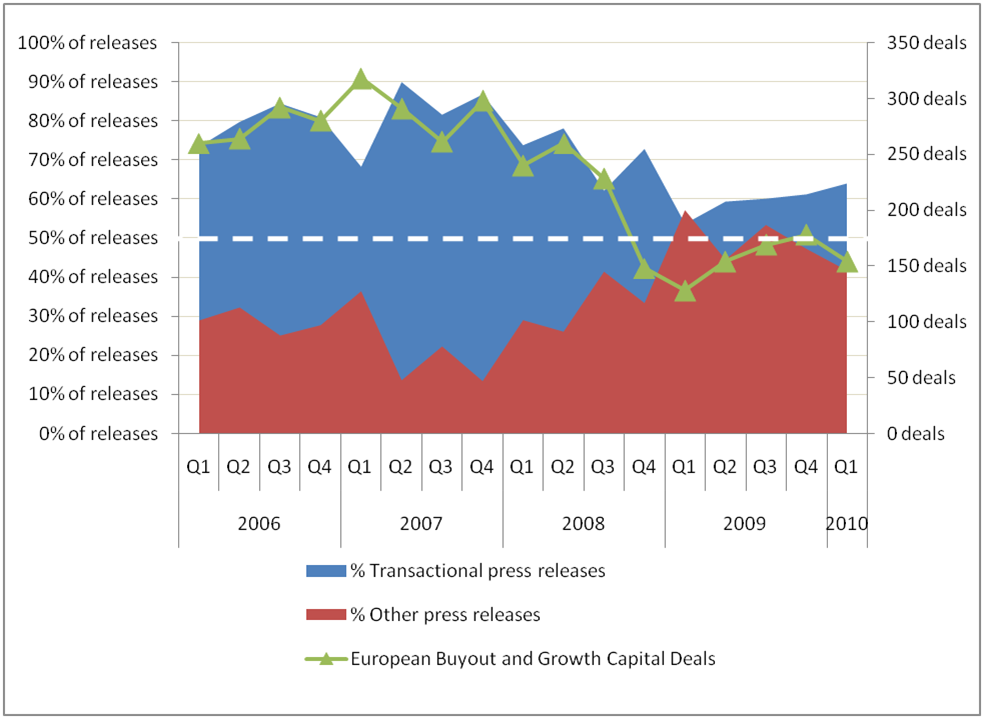

Well, the IE Consulting team and I read through almost 700 press releases from European buyout and growth capital investors (2006-2010) so you don’t have to. And the results of our research are summarised in an article in this month’s Private Equity Europe:

I think GPs are so focussed on announcing their transactions that they are neglecting the opportunities they have to communicate everything else they – and their portfolio companies – do. But what do you think? Please let me know, below!

Life as a Limited Partner during the financial crisis – The Good, the Bad and the Ugly

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

Earlier this month I had the honour and pleasure to be invited onto a panel at the 6th Annual Private Equity Forum at my alma mater. The panel sought to address how LPs had been affected by the financial crisis and, not being a Limited Partner myself, I thought it prudent to ask some, beforehand. If you were one of the 60 institutional investors into private equity that responded to my questionnaire, many thanks!

In any case, and as my colleagues predicted, there was no real need to call upon the research findings during the event. But some of the findings were so intriguing that I wanted to share them with you. I hope you find them as interesting as I did.

The link below will take you to a summary of the results.

Limited Partners in a New Era – the Good, the Bad, the Ugly

People prefer performance, and that will never change, but we found that many LPs had already ditched managers that they felt had not been communicating with them sufficiently well and some found that misalignment of interests between LP and GP (shock! horror! such DO exist!) had become more apparent during the crisis.

There’s much, much more in the full report, so I hope you will take the time to dive in. If you have any questions or comments, you know where to find me!

Do buyouts need more bad PR? At least the PE house is not at fault here!

You can Bank on it:

Delist at that price? You’ll get

Shareholders iRate

Apax Partners (full disclosure – my team is owned by one of their portfolio companies…I like to think it’s Apax’s favourite one :)) is trying to buy Bankrate. And some share holders are not too happy at the purchase price. Apax is paying a premium, of course, but some shareholders are not convinced the premium is fair.

Rather than the concerns of the conflict of interests that may develop between a private equity owner and an incumbent management team (particularly if that management team intends to stick around after the PE house exits), it is the management team itself that may be questioned in this instance. Has the share price been artificially deflated (don’t say sabotaged!) in order to present a more attractive purchase price for the buyout house and the management team/the team’s equity in the new deal?

The solution to all your woes – that’s if you are a GP and not a US taxpayer…

Private equity: /

Are you looking for lev’rage? /

Well, just buy a bank! /

1 buy bank

2 use leverage to fund new deals

3 refinance underperforming portfolio companies

4 clean up if all goes swimmingly

5 sell toxic bank assets to taxpayers if not, clean up

6 high fives all round

Private equity giant loses yet more millions, all perspective (or is that just the financial press?)

It’s all very well trying to see the positive in a bleak environment, but identifying a loss of close to $100m as good news seems a little “unusual”, to say the least.

When you think you see the light at the end of the tunnel, it’s as well to quickly make sure that you haven’t just been imprisoned for all eternity inside a giant torch…

Oh well done, fellas! /

We thought you’d lose more money. /

Let the good times roll /

Tumbleweeds, ghost towns, prospectors? Welcome to the fundraising Wild West (on the East coast)…

South Western GPs /

Can’t all be cowboys, can they? /

Where’s the darn sherrif?

Just on the off chance that you haven’t heard….here are the details…

Splitting up the record collection, PE style

Is it better to have invested and lost than never to have invested at all?

Girls, does it hurt when:

You make a commitment and

Some guy hands it back?

Love IS a battlefield