Archive

Bain: Global private equity report 2010

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

Bain & Company: “Global private equity report 2010” Bain briefs Publications.

I’ll provide some commentary when I get a chance to read it thoroughly. At first glance it looks very nicely laid out and is quite inviting for the reader, even if the corporate black and red is a little reminiscent of a casino table.

Leafing through it brings to mind the hilarious knockabout farce that was BCG and IESE’s 2008 offering The Advantage of Persistence: How the Best Private Equity Firms “Beat the Fade”, which you can read here.

It’s full of chioce tidbits that will leave you with aching sides and coffee on your monitor screen. AND it was co-authored by Heiko Meerkat.

But for those of you with a shorter attention span, how abut a quick look back to what McKinsey had to say about the buyout boom in 2007:

The recent tightening of credit markets has complicated the financing of some buyout deals and may dampen the flow of investor money into private equity firms. Skeptics on both sides of the Atlantic have been quick to proclaim that the private equity boom is over. But don’t expect private equity to suddenly fade to the background, as did the leveraged buyout boom of the 1980s. Even if growth slows in the short term, pension funds and other institutional investors will remain interested in private equity. McKinsey projects the industry’s assets under management may double by 2012, to $1.4 trillion.

Wow. AND “wow” again.

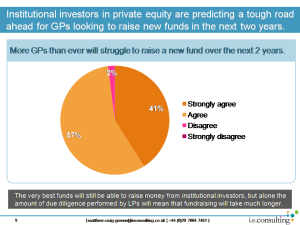

LPs: More GPs than ever will struggle to raise a fund over the next TWO years

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

Two years of winter:/

That’s what awaits those who did/

Not bury their nuts

We all know that times are tough for GPs out fundraising at the moment. But ask anyone on the sell-side and they’ll tell you the same thing:

2009 was horrible, but we expect things to pick up by the end of the year

A quick poll conducted by IE Consulting last month, however, suggests that times will remain tough for those PE houses out scavenging for LP commitments. Of course, the very best funds will come out and raise money. By the way, “very best funds” does not mean “top quartile” (anyone ever marketed a fund that wasn’t top quartile?). “Very best funds” means just that: those private equity and venture capital funds that have consistently delivered performance that outpaces its peers and other funds in other asset classes.

It’s simply no longer enough to be delivering better returns than other European buyout funds or other US venture funds. Limited Partners are taking a hard look at the dollars they are investing in private equity and VC funds and how the returns stack up against their other investment strategies: Commentators should not be surprised to see even committed investors into the asset class “taking stock” for a good while longer than even the most pessimistic might have expected.

So what does this mean for those in the market now, trying to raise a fund?

- Get out early. You could be in the market for 18 months or more

- Be flexible. Respect the fact that the balance of power now rests with your LPs: They have alternatives.

- Show how you are different. A longer fundraising timetable means more “competing” funds on the road at the same time. Why should LPs invest in your fund?

- Don’t forget to make the case for private equity: Is your strategy preferable to investing in the public market? How?

I remember a conversation I had in 2008 with the head of investor relations at one of the preeminent large buyout houses. After exchanging niceties and discussing the industry landscape, talk turned to their current fundraising activity. Apparently, the firm was engaged in “philosophical” discussions as to whether it should even include a market commentary section in its PPM. After all:

“everyone knows what we do and why they should be investing in our funds”

Oh, how things have changed…

You can read the full research summary from our LP poll here:

More than a big deal? What GPs think worth communicating

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

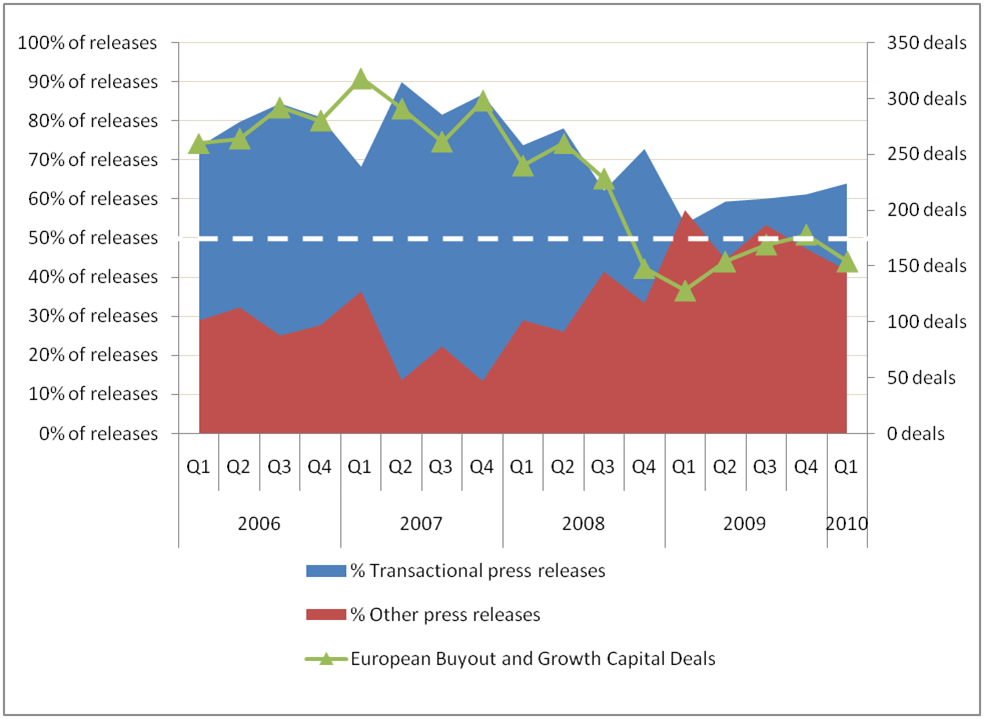

Well, the IE Consulting team and I read through almost 700 press releases from European buyout and growth capital investors (2006-2010) so you don’t have to. And the results of our research are summarised in an article in this month’s Private Equity Europe:

I think GPs are so focussed on announcing their transactions that they are neglecting the opportunities they have to communicate everything else they – and their portfolio companies – do. But what do you think? Please let me know, below!

Life as a Limited Partner during the financial crisis – The Good, the Bad and the Ugly

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

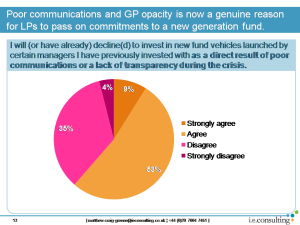

Earlier this month I had the honour and pleasure to be invited onto a panel at the 6th Annual Private Equity Forum at my alma mater. The panel sought to address how LPs had been affected by the financial crisis and, not being a Limited Partner myself, I thought it prudent to ask some, beforehand. If you were one of the 60 institutional investors into private equity that responded to my questionnaire, many thanks!

In any case, and as my colleagues predicted, there was no real need to call upon the research findings during the event. But some of the findings were so intriguing that I wanted to share them with you. I hope you find them as interesting as I did.

The link below will take you to a summary of the results.

Limited Partners in a New Era – the Good, the Bad, the Ugly

People prefer performance, and that will never change, but we found that many LPs had already ditched managers that they felt had not been communicating with them sufficiently well and some found that misalignment of interests between LP and GP (shock! horror! such DO exist!) had become more apparent during the crisis.

There’s much, much more in the full report, so I hope you will take the time to dive in. If you have any questions or comments, you know where to find me!

Open, for business… Private equity firms and transparency

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]

As promised, I’ve uploaded a pdf of the first article on IE Consulting’s new research into the way that GPs are communicating and how open they are to inbound communication. You can access it below:

This first installment looks at some of the absolute basics of open communication: How easy is it for an interested party (press, Limited Partner, intermediary, etc) to find contact details for individuals within the firm.

Sorry I couldn’t get it to embed properly!

“Open, for business?” full article on docstoc.com

The next piece in Private Equity Europe will lok at the thematic content of prtess releases from buyout investors in Europe since January 2006. And there will be more in the coming weeks, so watch this space…

How transparent are private equity fund managers really? What do you think?

[tweetmeme source=”mattcg” service=”bit.ly” only_single=”false”]Private equity fund managers have been under pressure in recent years to improve both the reporting they undertake to their institutional investors and the transparency with which they operate, in general. Government, regulators, the press, Limited Partners: they all want to know more about the activites of GPs. My colleagues and I at IE Consulting have spent some time looking at the press releases of the most active General Partners in Europe.

We looked at:

- The access provided to dealmakers and communications staff through their websites

- The thematic content of all press releases issued since January 2006

- The quantitative and qualitative content of all press releases pertaining to buyout investments issued in the last 12 months

Some of the results were surprising, some disappointing, some encouraging, and some downright astonishing.

The results will be published in Private Equity Europe and the first installment is out at the end of this week.

Of course, I’ll be uploading the information here, too!

In the meantime, I’m interested in your thoughts:

Should private equity firms be more transparent?

If so, are they trying hard enough?

And how successful are they being?

Perhaps you work at a GP in a marketing or communications or PR role or you are a journalist, regulator or LP. Either way, I am sure you have some interesting thoughts on this. Let me know in the comments!

European Private Equity Survey – mid-market

If you’ve got 5-10 minutes spare and you work on European private equity transactions as either a deal exec, an origination specialist, or an advisor, please take this survey . We ran something similar last year and are looking to see how the market has changed.

The results, along with those of last year and a whole host of other goodies will be available free of charge to all respondents.

Thanks in advance!